Budget overview

The Government’s economic plan to ensure Australia continues to successfully transition from the mining investment boom to a stronger, more diversified, new economy.

Appendix A

Budget aggregates

The table below shows the main cash and accrual budget aggregates for the Australian Government general government sector over the period 2014-15 to 2019-20

More comprehensive information is provided in Budget Paper No.1, Statement 3

| Actual | Estimates | Projections | ||||

|---|---|---|---|---|---|---|

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | |

| $b | $b | $b | $b | $b | $b | |

| Receipts | 378.3 | 388.0 | 411.3 | 437.4 | 469.9 | 500.7 |

| Per cent of GDP | 23.5 | 23.5 | 23.9 | 24.2 | 24.8 | 25.1 |

| Payments (a) | 412.1 | 425.0 | 445.0 | 459.9 | 481.5 | 502.6 |

| Per cent of GDP | 25.6 | 25.8 | 25.8 | 25.5 | 25.4 | 25.2 |

| Net Future Fund earnings | 4.1 | 3.0 | 3.3 | 3.6 | 3.8 | 4.1 |

| Underlying cash balance(b) | -37.9 | -39.9 | -37.1 | -26.1 | -15.4 | -6.0 |

| Per cent of GDP | -2.4 | -2.4 | -2.2 | -1.4 | -0.8 | -0.3 |

| Revenue | 380.7 | 396.4 | 416.9 | 449.5 | 484.4 | 515.1 |

| Per cent of GDP | 23.7 | 24.0 | 24.2 | 24.9 | 25.5 | 25.9 |

| Expenses | 417.9 | 431.5 | 450.6 | 464.8 | 489.3 | 511.6 |

| Per cent of GDP | 26.0 | 26.1 | 26.2 | 25.7 | 25.8 | 25.7 |

| Net operating balance | -37.2 | -35.1 | -33.7 | -15.3 | -5.0 | 3.5 |

| Net capital investment | 2.7 | 4.4 | 3.4 | 3.4 | 4.9 | 5.5 |

| Fiscal balance | -39.9 | -39.4 | -37.1 | -18.7 | -9.8 | -2.1 |

| Per cent of GDP | -2.5 | -2.4 | -2.2 | -1.0 | -0.5 | -0.1 |

| Memorandum item: | ||||||

| Headline cash balance | -38.9 | -51.5 | -53.4 | -34.2 | -23.9 | -14.4 |

(a) Equivalent to cash payments for operating

activities, purchases of non-financial assets and net acquisition of

assets under

finance leases.

(b) Excludes net Future Fund earnings

Appendix B

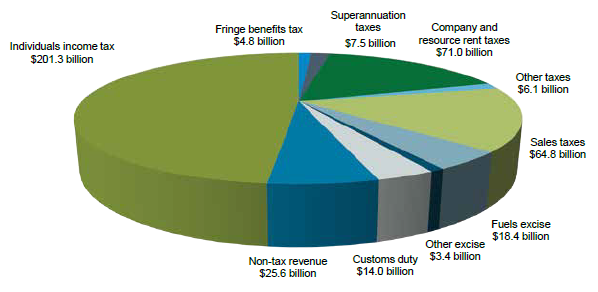

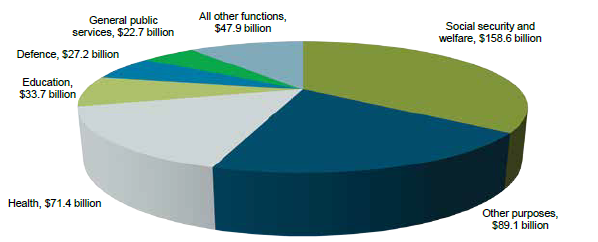

Revenue and spending

Total revenue for 2016-17 is expected to be $416.9 billion, an increase of 5.2 per cent on estimated revenue in 2015-16. Total expenses for 2016-17 are expected to be $450.6 billion, an increase of 4.4 per cent on estimated expenses in 2015-16.

Appendix C

Major initiatives

This table summarises the major initiatives in the 2016-17 Budget and their impact on the fiscal balance

More comprehensive information is provided in Budget Paper No. 2, Budget Measures 2016-17

| Initiatives | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | Total |

|---|---|---|---|---|---|---|

| $m | $m | $m | $m | $m | $m | |

| Public Hospitals – new funding arrangements | 0.0 | 0.0 | -477.2 | -936.8 | -1,445.8 | -2,859.8 |

| School funding– additional funding from 2018 | - | - | -102.2 | -306.1 | -519.3 | -927.6 |

| Commonwealth Assistance for Western Australia | -490.0 | 0.0 | 0.0 | 0.0 | 0.0 | -490.0 |

| Operation Okra – extension | - | -351.5 | -22.1 | -13.9 | - | -387.6 |

| Youth Employment Package – Youth Jobs PaTH (Prepare-Trial-Hire) | -0.1 | -12.1 | -70.1 | -83.8 | -83.4 | -249.5 |

| Operation Accordion – extension | - | -186.2 | -7.0 | -3.2 | - | -196.4 |

| My Aged Care – consumer access | - | -29.6 | -30.9 | -35.5 | -40.5 | -136.5 |

| Cyber Security – implementation of Australia's Cyber Security Strategy | 0.0 | -19.2 | -28.9 | -33.3 | -37.2 | -118.6 |

| School funding– additional funding for students with a disability | - | -86.7 | -31.6 | - | - | -118.3 |

| Western Sydney Airport – further preparatory works | - | -65.6 | -49.5 | - | - | -115.1 |

| National Resources Development Strategy – exploring for the future | - | -24.5 | -20.4 | -30.8 | -24.9 | -100.5 |

| Aged Care Provider Funding - improving the targeting of the viability supplement for regional aged care facilities | - | -12.6 | -26.1 | -27.4 | -29.3 | -95.4 |

| Investment Approach to Welfare – Try, Test and Learn Fund | - | -31.7 | -31.4 | -24.8 | -8.2 | -96.1 |

| Youth Employment Package – encouraging entrepreneurship and self-employment | - | -16.2 | -24.2 | -24.0 | -24.2 | -88.6 |

| Clean and Renewable Energy Innovation – Clean Energy Finance Corporation and the Australian Renewable Energy Agency | 1.0 | -47.5 | -43.3 | -13.0 | 30.0 | -72.9 |

All figures are in net fiscal impact terms.

| Revenue items | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | Total |

|---|---|---|---|---|---|---|

| $m | $m | $m | $m | $m | $m | |

| Tobacco excise – measures to improve health outcomes and combat illicit tobacco | - | -2.9 | 690.1 | 1550.0 | 2470.0 | 4,707.2 |

| Ten Year Enterprise Tax Plan– targeted personal income tax relief | - | -800.0 | -950.0 | -1050.0 | -1150.0 | -3,950.0 |

| Tax Integrity Package– establishing the Tax Avoidance Taskforce | - | 28.6 | 564.4 | 1071.2 | 1395.8 | 3,060.0 |

| Ten Year Enterprise Tax Plan– reducing the company tax rate to 25 per cent | - | -400.0 | -500.0 | -800.0 | -950.0 | -2,650.0 |

| Superannuation Reform Package– reforming the taxation of concessional superannuation contributions | - | -2.8 | 499.1 | 797.8 | 1148.9 | 2,443.0 |

| Ten Year Enterprise Tax Plan– increase the small business entity turnover threshold | - | -280.0 | -700.0 | -550.0 | -650.0 | -2,180.0 |

| Superannuation Reform Package– introduce a $1.6 million superannuation transfer balance cap | - | -4.4 | 550.0 | 700.0 | 750.0 | 1,995.6 |

| Superannuation Reform Package– introducing a Low Income Superannuation Tax Offset (LISTO) | - | - | -102.8 | -701.1 | -801.1 | -1,605.0 |

| Superannuation Reform Package– tax deductions for personal superannuation contributions | - | - | 350.0 | -600.0 | -750.0 | -1,000.0 |

Footnote: All figures are in net fiscal impact terms.

Appendix D

Major savings

This table summarises the major savings in the 2016-17 Budget and their impact on the fiscal balance

More comprehensive information is provided in Budget Paper No. 2, Budget Measures 2016-17

| 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | Total | |

|---|---|---|---|---|---|---|

| $m | $m | $m | $m | $m | $m | |

| National Disability Insurance Scheme Savings Fund | 72.0 | 162.4 | 408.5 | -1,062.2 | 2,676.8 | 2,257.6 |

| Higher Education Reform – further consultation | 28.4 | 133.7 | 488.6 | 569.2 | 790.5 | 2,010.5 |

| Public Sector Transformation and the Efficiency Dividend | 0.0 | 0.0 | 298.6 | 510.5 | 614.6 | 1,423.8 |

| Jobs for Families Package – deferred implementation | 60.0 | 43.4 | 1,152.6 | -7.3 | -86.2 | 1,162.5 |

| Aged Care Provider Funding– further revision of the Aged Care Funding Instrument | -0.2 | 119.0 | 229.5 | 339.5 | 463.9 | 1,151.7 |

| Medicare Benefits Schedule– pause indexation | 0.0 | 0.0 | 0.0 | 301.5 | 623.8 | 925.3 |

| Asset Recycling Initiative – return of unallocated funds | 0.0 | 452.7 | 307.4 | 93.5 | 0.0 | 853.6 |

| Youth Employment Package – Work for the Dole - reform | 0.0 | 128.1 | 120.7 | 123.0 | 122.5 | 494.2 |

| Industry Skills Fund – efficiencies | 24.6 | 55.8 | 55.6 | 55.6 | 55.6 | 247.2 |

| Job Commitment Bonus – cessation | -0.4 | 45.8 | 66.1 | 65.5 | 65.0 | 242.0 |

| Health Flexible Funds – pausing indexation and achieving efficiencies | - | - | 31.9 | 57.8 | 92.4 | 182.1 |

| Reforming the Visa and Migration Framework | - | - | 20.0 | 70.0 | 90.0 | 180.0 |

| Infrastructure Investment Programme – efficiencies | 0.0 | 7.8 | 0.3 | 4.2 | 150.4 | 162.7 |

| Higher Education Participation Program – efficiencies | - | 13.0 | 18.1 | 33.1 | 88.1 | 152.3 |

| Department of Human Services – administrative efficiencies | - | 20.0 | 20.0 | 20.0 | 20.0 | 80.0 |

| A Streamlined Pathway to Permanent Residence for New Zealand Citizens | 0.0 | -2.1 | 9.3 | 24.4 | 33.5 | 65.1 |

| Onshore Immigration Detention Network – consolidation | -1.6 | -9.8 | 6.8 | 24.0 | 38.0 | 57.4 |

| Child and Adult Public Dental Scheme | -4.1 | 60.6 | 50.5 | 32.8 | -122.4 | 17.4 |

All figures are in net fiscal impact terms.

Appendix E

Detailed economic forecasts(a)

The table below shows the Government’s macroeconomic forecasts

More comprehensive information is provided in Budget Paper No.1, Statement 2

| Outcomes(b) | Forecasts | |||

|---|---|---|---|---|

| 2014-15 | 2015-16 | 2016-17 | 2017-18 | |

| Real gross domestic product | 2.2 | 2 1/2 | 2 1/2 | 3 |

| Household consumption | 2.7 | 3 | 3 | 3 |

| Dwelling investment | 7.9 | 8 | 2 | 1 |

| Total business investment(c) | -6.2 | -11 | -5 | 0 |

| By industry | ||||

| Mining investment | -17.3 | -27 1/2 | -25 1/2 | -14 |

| Non-mining investment | 1.2 | -2 | 3 1/2 | 4 1/2 |

| Private final demand(c) | 1.0 | 1/2 | 1 1/2 | 2 1/2 |

| Public final demand(c) | 0.0 | 2 1/4 | 2 1/4 | 2 |

| Change in inventories(d) | 0.2 | 0 | 0 | 0 |

| Gross national expenditure | 0.9 | 1 | 1 3/4 | 2 1/2 |

| Exports of goods and services | 6.5 | 6 | 5 | 5 1/2 |

| Imports of goods and services | 0.0 | 0 | 2 1/2 | 3 |

| Net exports(d) | 1.4 | 1 1/4 | 3/4 | 3/4 |

| Nominal gross domestic product | 1.6 | 2 1/2 | 4 1/4 | 5 |

| Prices and wages | ||||

| Consumer price index(e) | 1.5 | 1 1/4 | 2 | 2 1/4 |

| Wage price index(f) | 2.3 | 2 1/4 | 2 1/2 | 2 3/4 |

| GDP deflator | -0.6 | 0 | 1 3/4 | 1 3/4 |

| Labour market | ||||

| Participation rate (per cent)(g) | 64.8 | 65 | 65 | 65 |

| Employment(f) | 1.6 | 2 | 1 3/4 | 1 3/4 |

| Unemployment rate (per cent)(g) | 6.1 | 5 3/4 | 5 1/2 | 5 1/2 |

| Balance of payments | ||||

| Terms of trade(h) | -10.3 | -8 3/4 | 1 1/4 | 0 |

| Current account balance (per cent of GDP) | -3.7 | -4 3/4 | -4 | -3 1/2 |

(a) Percentage change on preceding year unless otherwise indicated.

(b) Calculated using original data unless otherwise indicated.

(c) Excluding second-hand asset sales from the public sector to the private sector.

(d) Percentage point contribution to growth in GDP.

(e) Through-the-year growth rate to the June quarter.

(f) Seasonally adjusted, through-the-year growth rate to the June

quarter. (g) Seasonally adjusted rate for the June quarter.

(h) The forecasts are underpinned by spot prices of $55 ($US/t, FOB)

for iron ore; $91 ($US/t, FOB) for metallurgical coal and $52

($US/t, FOB) for thermal coal.

Note: The forecasts for the domestic economy are based on several technical assumptions. The exchange rate is assumed to remain around its recent average level — a trade-weighted index of around 64 and a $US exchange rate of around 77 US cents. Interest rates are assumed to move broadly in line with market expectations. World oil prices (Malaysian Tapis) are assumed to remain around US$43 per barrel.

Source: ABS cat. no. 5204.0, 5206.0, 5302.0, 6202.0, 6345.0, 6401.0, unpublished ABS data and Treasury.

Appendix F

Historical budget and net financial worth data

This table provides historical data and forward estimates for Australian Government General Government Sector cash receipts, cash payments, the underlying cash balance and net financial worth

More comprehensive information is provided in Budget Paper No. 1, Budget Strategy and Outlook Statement 10

| Receipts(a) | Payments(b) | Underlying cash balance(c) | Net financial worth(d) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| $m | Per cent of GDP |

$m | Per cent of GDP |

$m | Per cent of GDP |

$m | Per cent of GDP |

||||

| 1985-86 | 66,206 | 25.4 | 71,328 | 27.4 | -5,122 | -2.0 | na | na | |||

| 1986-87 | 74,724 | 26.2 | 77,158 | 27.0 | -2,434 | -0.9 | na | na | |||

| 1987-88 | 83,491 | 25.8 | 82,039 | 25.3 | 1,452 | 0.4 | na | na | |||

| 1988-89 | 90,748 | 24.7 | 85,326 | 23.2 | 5,421 | 1.5 | na | na | |||

| 1989-90 | 98,625 | 24.4 | 92,684 | 22.9 | 5,942 | 1.5 | na | na | |||

| 1990-91 | 100,227 | 24.2 | 100,665 | 24.3 | -438 | -0.1 | na | na | |||

| 1991-92 | 95,840 | 22.7 | 108,472 | 25.6 | -12,631 | -3.0 | na | na | |||

| 1992-93 | 97,633 | 22.0 | 115,751 | 26.1 | -18,118 | -4.1 | na | na | |||

| 1993-94 | 103,824 | 22.3 | 122,009 | 26.1 | -18,185 | -3.9 | na | na | |||

| 1994-95 | 113,458 | 22.9 | 127,619 | 25.8 | -14,160 | -2.9 | na | na | |||

| 1995-96 | 124,429 | 23.5 | 135,538 | 25.6 | -11,109 | -2.1 | na | na | |||

| 1996-97 | 133,592 | 24.0 | 139,689 | 25.1 | -6,099 | -1.1 | na | na | |||

| 1997-98 | 140,736 | 23.9 | 140,587 | 23.9 | 149 | 0.0 | na | na | |||

| 1998-99 | 152,063 | 24.5 | 148,175 | 23.9 | 3,889 | 0.6 | na | na | |||

| 1999-00 | 166,199 | 25.2 | 153,192 | 23.2 | 13,007 | 2.0 | -67,036 | -10.1 | |||

| 2000-01 | 182,996 | 25.9 | 177,123 | 25.1 | 5,872 | 0.8 | -71,876 | -10.2 | |||

| 2001-02 | 187,588 | 24.9 | 188,655 | 25.0 | -1,067 | -0.1 | -78,032 | -10.4 | |||

| 2002-03 | 204,613 | 25.6 | 197,243 | 24.6 | 7,370 | 0.9 | -82,931 | -10.4 | |||

| 2003-04 | 217,775 | 25.3 | 209,785 | 24.4 | 7,990 | 0.9 | -72,389 | -8.4 | |||

| 2004-05 | 235,984 | 25.6 | 222,407 | 24.1 | 13,577 | 1.5 | -58,882 | -6.4 | |||

| 2005-06 | 255,943 | 25.7 | 240,136 | 24.1 | 15,757 | 1.6 | -59,763 | -6.0 | |||

| 2006-07 | 272,637 | 25.1 | 253,321 | 23.3 | 17,190 | 1.6 | -35,696 | -3.3 | |||

| 2007-08 | 294,917 | 25.0 | 271,843 | 23.1 | 19,754 | 1.7 | -14,690 | -1.2 | |||

| 2008-09 | 292,600 | 23.3 | 316,046 | 25.1 | -27,013 | -2.1 | -71,490 | -5.7 | |||

| 2009-10 | 284,662 | 22.0 | 336,900 | 26.0 | -54,494 | -4.2 | -144,485 | -11.1 | |||

| 2010-11 | 302,024 | 21.4 | 346,102 | 24.5 | -47,463 | -3.4 | -198,787 | -14.1 | |||

| 2011-12 | 329,874 | 22.1 | 371,032 | 24.9 | -43,360 | -2.9 | -355,834 | -23.9 | |||

| 2012-13 | 351,052 | 23.0 | 367,204 | 24.1 | -18,834 | -1.2 | -312,724 | -20.5 | |||

| 2013-14 | 360,322 | 22.7 | 406,430 | 25.6 | -48,456 | -3.1 | -370,331 | -23.4 | |||

| 2014-15 | 378,301 | 23.5 | 412,079 | 25.6 | -37,867 | -2.4 | -421,129 | -26.2 | |||

| 2015-16 (e) | 388,027 | 23.5 | 424,961 | 25.8 | -39,946 | -2.4 | -387,893 | -23.5 | |||

| 2016-17 (e) | 411,284 | 23.9 | 445,045 | 25.8 | -37,081 | -2.2 | -427,167 | -24.8 | |||

| 2017-18 (e) | 437,385 | 24.2 | 459,934 | 25.5 | -26,123 | -1.4 | -445,192 | -24.6 | |||

| 2018-19 (p) | 469,921 | 24.8 | 481,484 | 25.4 | -15,406 | -0.8 | -454,319 | -24.0 | |||

| 2019-20 (p) | 500,742 | 25.1 | 502,556 | 25.2 | -5,955 | -0.3 | -455,789 | -22.9 | |||

(a) Receipts are equal to cash receipts from operating activities and sales of non-financial assets.

(b) Payments are equal to cash payments for operating activities,

purchases of non-financial assets and net acquisition of assets under

finance leases.

(c) Underlying cash balance is equal to receipts less payments, less

net Future Fund earnings. For the purposes of consistent comparison

with years prior to 2005-06, net Future Fund earnings should be added

back to the underlying cash balance.

(d) Net financial worth is equal to financial assets less total liabilities.

(e) Estimates.

(p) Projections.

Note: Full historical series going back to 1970-71 are available in

Budget Paper No. 1, Budget Strategy and Outlook, Statement 10.